Understanding Loan-to-Value Ratio in Mortgages

When embarking on the journey of mortgage lending, one of the most significant factors we weigh is the Loan-to-Value (LTV) ratio. As seasoned professionals in the realm of real estate financing, we’ve come to recognize the importance of this metric both for lenders and homeowners. The LTV stands as a beacon, guiding the decision-making process […]

Exploring Loan Term Options: Find Your Perfect Fit

As seasoned experts in finance, we understand that navigating the world of mortgage options can be a daunting task, especially for the first-time homebuyer. Finding that sweet spot where monthly payments, interest rates, and the duration of the loan align with your financial goals isn’t always straightforward. That’s why we’re committed to guiding you through […]

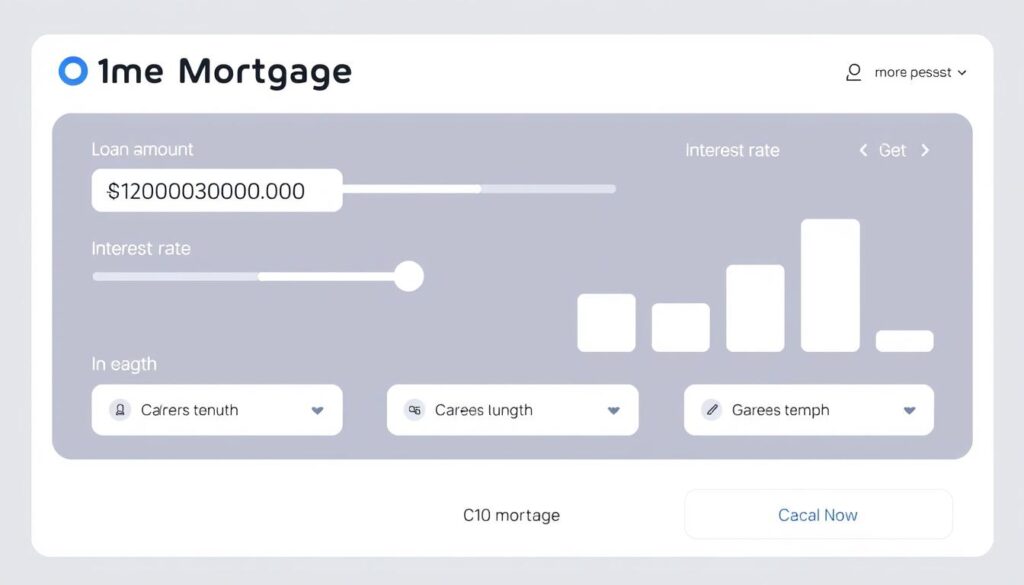

Mortgage Calculator: Easy Home Loan Estimator

Embarking on the journey of homeownership or refinancing your property requires a clear understanding of your financial commitments. Our mortgage calculator is an invaluable resource tailored to simplify the home financing process. By providing a user-friendly platform, we enable you to estimate home loan payments efficiently, taking into account various factors such as home price, […]

Down Payment Assistance: Get Help Buying Your Home

As we navigate the challenging landscape of the housing market, down payment grants and home ownership assistance programs emerge as vital tools for many Americans. Our goal is to shed light on the path to affordable housing initiatives and provide dependable guidance on mortgage assistance. For those looking to plant roots, down payment assistance (DPA) […]

Adjustable-Rate Mortgages: What You Need to Know

At the very cornerstone of navigating homeownership finance, Adjustable-Rate Mortgages, commonly known as ARM loans, emerge as a flexible option for many aspiring homeowners. By virtue of their evolving interest rates, ARMs undeniably require a nuanced understanding. We’ll dissect the essentials of ARM loans and elucidate how they can be leveraged to your advantage, particularly […]

Jumbo Loans: Big Mortgages for Luxury Homes

As we delve into the world of high-end property acquisition, it’s imperative to understand the significance of Jumbo Loans in the realm of Mortgage Financing. These Non-Conforming Mortgages are quintessential for those eyeing Luxury Real Estate, offering the financial heft to take ownership of High-Value Properties which surpass the standards of the Federal Housing Finance […]

VA Loans: Benefits for Military Homebuyers

As we honor the service of our nation’s heroes, we’re also committed to easing their transitions into homeownership. VA home loans stand out as a powerful tool in achieving this goal, exclusively for those who’ve worn our country’s uniform. These military home loans, fully backed by the Department of Veterans Affairs, provide a myriad of […]

Essential Tips for First-Time Homebuyers

As we step into the realm of homeownership, we recognize the challenges that first-time homebuyers face in today’s U.S. housing market. With mortgage rates at their peak in nearly a quarter-century, and housing prices reaching unprecedented heights, not to mention the scarcity of affordable housing, it’s never been more important to approach the home buying […]

Mortgage Rates: Find Your Best Home Loan Today

Securing a home is a significant milestone, and with the right home loans, achieving your real estate goals is within reach. At present, the national average 30-year fixed mortgage Annual Percentage Rate (APR) stands at 6.48%, closely shadowed by the fixed refinancing rate of 6.49%. Our mission is to guide you through the dynamic landscape […]