Escrow Accounts Explained: Why They’re Important

In the realm of property transactions, the escrow account serves as a fundamental security measure, safeguarding the interests of all parties involved in the mortgage process. As we navigate the complexities of buying or selling real estate, the escrow account emerges not merely as a beneficial option, but as a critical element that assures a […]

What Does a Mortgage Underwriter Do?

At the heart of every home loan approval is a discerning professional, whose expertise shapes the outcome of a mortgage application. This is the role of mortgage underwriter – a key player tasked with the assessment of financial reliability and risk. Our role as mortgage underwriters requires a deep dive into an applicant’s financial history […]

The Importance of Home Appraisals in the Mortgage Process

In the complex journey of homebuying, the home appraisal process stands as a fundamental milestone, anchoring the financial stability of all entities involved. As we navigate the intricacies of acquiring a mortgage appraisal, it’s crucial to recognize that this detailed evaluation serves more than just a transactional purpose—it’s a comprehensive assurance of value. Through rigorous […]

Mortgage Approval Process: What to Expect and How to Prepare

Navigating the maze of mortgage approval steps can seem daunting, particularly for those setting foot on this journey for the first time. As seasoned guides through the complexities of getting mortgage approved, we’re here to provide you with an empowering blueprint to make your voyage from aspiring homeowner to keyholder as seamless as possible. A […]

Top Mortgage Lenders in 2024: Our Recommendations

As we traverse the dynamic world of real estate financing in 2024, our team has conducted thorough mortgage company reviews to present you with a refined list of the top-rated mortgage lenders. In a market where every basis point counts, these institutions not just meet, but exceed expectations, delivering exceptional service and comprehensive mortgage solutions. […]

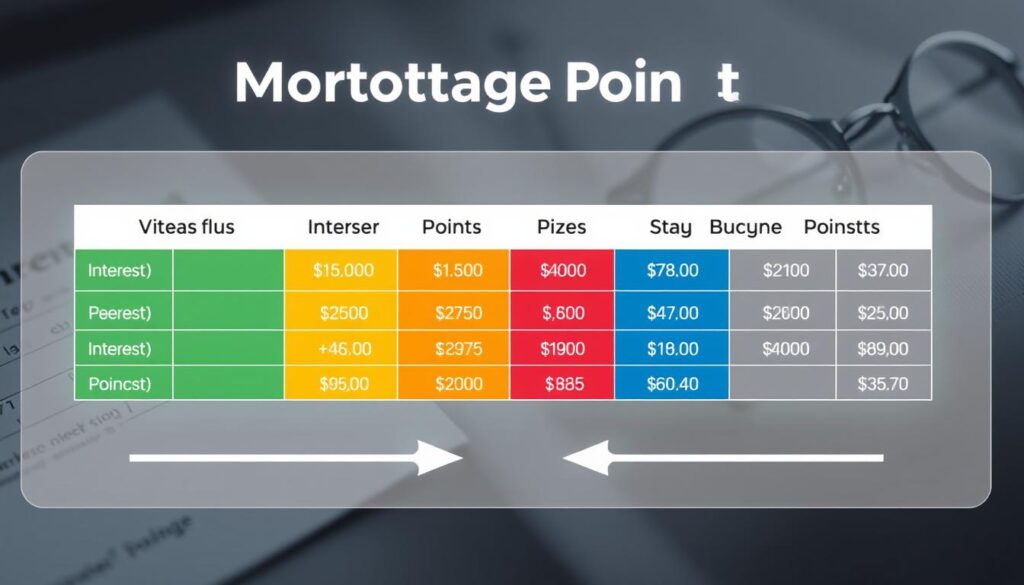

What Are Mortgage Points, and Should You Buy Them?

In the journey to homeownership, we come across various checkpoints that can significantly shape our financial obligations. Among these are mortgage points—a tool that could be instrumental in reducing our long-term expenses on a home loan. Often encountered in mortgage negotiations, understanding mortgage points benefits can be the key to unlocking savings on your mortgage […]

USDA Loans Explained: A Path to Rural Homeownership

Amidst the challenges of attaining homeownership, USDA loans emerge as a beacon of hope for individuals seeking a life in the pastoral settings of rural America. As advocates for economic vitality and improvement of living standards in less urbanized regions, we recognize the significance of these government-backed home loans. USDA loans not only exemplify a […]

How Bi-Weekly Payments Can Save You Thousands

We often seek out ways to free ourselves from debt more swiftly and to save money along our financial journey. Bi-weekly mortgage payments stand as a beacon of efficiency in this endeavor. With each passing two weeks, we find ourselves one step closer to the satisfaction of a fully paid home. And as the numbers […]

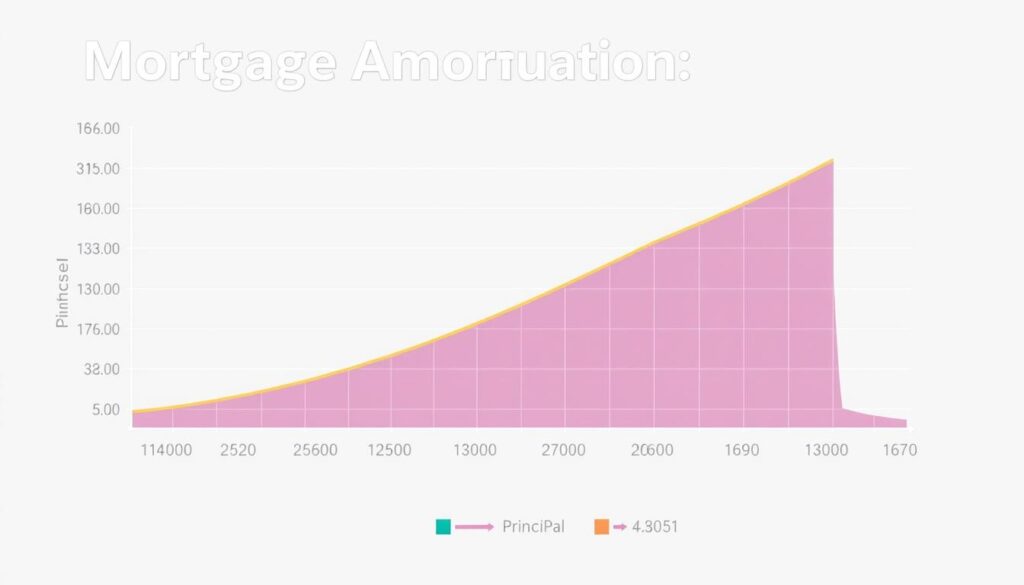

Understanding Mortgage Amortization and Your Payments

When we delve into the world of homeownership, a foundational concept is the practice of amortizing home loans, a term that often enters discussions about financial planning and property investment. Essentially, by understanding loan amortization, we can dissect the method of repaying a mortgage in systematic monthly installments over an agreed period. A traditional 30-year […]

Pros and Cons of an Interest-Only Mortgage

As we navigate the realm of home financing, the interest-only mortgage often surfaces as a considerable option, particularly for those seeking low payment mortgage solutions. At its core, an interest-only mortgage facilitates lower monthly outlays initially, as borrowers remit payments solely towards the loan interest. This type of financing arrangement tends to offer breathing room […]