“Six Ways to Get Cash Without Using Your Debit Card”

How to Withdraw Money Without a Debit Card Whether you’ve lost your debit card or simply forgotten to carry it with you, there are times when you need to access cash from your checking account without a physical card. Fortunately, there are several ways to withdraw money without a debit card. In this blog, we’ll […]

“Everything You Need to Know About Starting an IRA”

How to Open and Fund an IRA: A Comprehensive Guide Opening an individual retirement account (IRA) is a crucial step toward securing your financial future. With the right approach, you can take advantage of tax benefits and maximize your retirement savings. In this guide, we’ll walk you through the process of selecting an IRA type, […]

“Investing in Your Child’s Future: The Benefits of CDs”

Teaching Financial Literacy to Children: The Benefits of Opening a CD Looking to help your child learn essential life skills like money management? Opening a certificate of deposit (CD) can be an excellent way to teach children about saving, interest rates, and more. At O1ne Mortgage, we believe in empowering the next generation with financial […]

Improving Your Credit After an Adverse Action Notice

Understanding Adverse Action Letters and How to Improve Your Credit Receiving an adverse action letter can be a daunting experience, but it’s important to understand what it means and how you can respond effectively. At O1ne Mortgage, we are committed to helping you navigate through these challenges and improve your credit standing. If you have […]

Building a Diversified Portfolio: Picking the Right Mutual Funds

How to Choose the Right Mutual Funds for Your Investment Goals Mutual funds offer a convenient way to diversify your investments by pooling your money with other investors. Instead of researching and buying individual assets yourself, you can invest in a mutual fund to spread your risk across a variety of assets. However, with thousands […]

“From Rent to Utilities: How Everyday Bills Can Affect Your Credit”

Understanding How Bills Affect Your Credit Scores At O1ne Mortgage, we understand that managing your finances can be complex, especially when it comes to understanding how your bills impact your credit scores. In this blog, we will delve into the various types of accounts that can affect your credit scores, how you can get credit […]

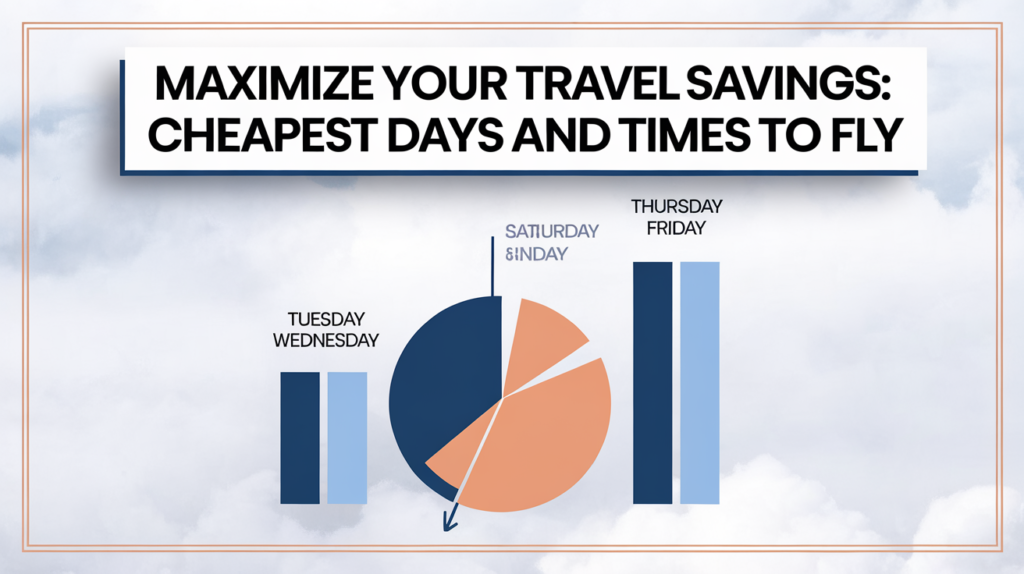

“Is a Travel Credit Card Right for You? A Detailed Analysis”

Maximize Your Travel Rewards with the Right Credit Card At O1ne Mortgage, we understand the importance of making informed financial decisions, especially when it comes to travel. Whether you’re a frequent flyer, a family vacationer, or someone saving up for a special trip, choosing the right travel credit card can make a significant difference. In […]

“Annuities and IRAs: Key Differences and Benefits Explained”

Understanding IRAs and Annuities: Which is Right for Your Retirement? When planning for retirement, it’s crucial to understand the different financial vehicles available to you. Two popular options are Individual Retirement Accounts (IRAs) and annuities. Both offer unique benefits and can play a significant role in your retirement strategy. In this blog, we’ll explore the […]

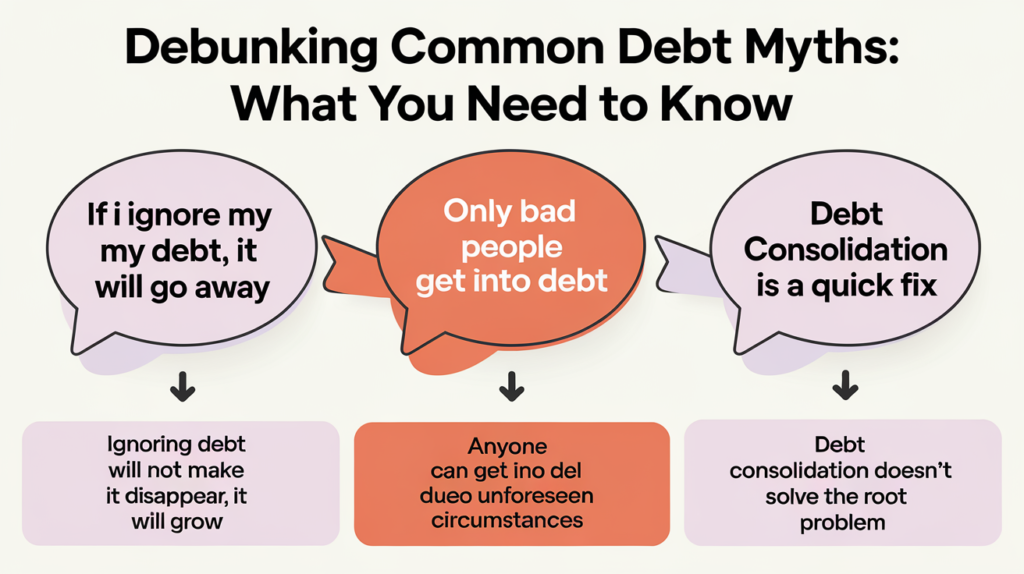

“Managing Debt Consolidation: Tips to Protect and Improve Your Credit Score”

Debt consolidation is a financial strategy that involves combining multiple debts into a single loan or credit card, ideally with a lower interest rate. This process can have both positive and negative effects on your credit score. At O1ne Mortgage, we understand the intricacies of debt consolidation and are here to help you navigate this […]

“How to Make the Most of Your Money Market Account: Avoid These Errors”

Maximizing Your Savings: Avoid These Common Money Market Account Mistakes Money market accounts are a unique blend of savings and checking accounts, offering the high interest rates of savings accounts with the accessibility of checking accounts. However, to truly benefit from a money market account, it’s crucial to avoid common pitfalls that can diminish your […]